Without sugarcoating things, death is inevitable, and incapacitation is unpredictable. Nobody ever knows what tomorrow holds, and that’s why you need to look for ways to accomplish what you have in mind while you still have the time. You probably have things like assets, trusts, and guardianships that you wish to be handled in a way known to you alone. Well, that is why you need to have an estate plan. Though it may sound like a will, it isn’t. As you come up with the plan, you will have some goals in mind. Here are some tips you can follow to ensure your estate planning goals are achieved.

1. Involved the Appropriate Professionals

Estate planning involves a wide range of aspects that require different types and levels of expertise from trust and probate solicitors. To make sure all aspects of the plan are catered for, you need to have a team of professionals by your side. As the folks over at The Atlanta Estate Law Center insist, an estate planning attorney is one of the professionals you will need to involve. They will walk with you every step of the way to ensure the process flows smoothly and everything is done legally. You will also need other professionals like a tax advisor and a financial advisor to help ensure tackle the various financial aspects involved. This way, you can have an estate plan that is customized to cater to your needs.

2. Document Your Wishes

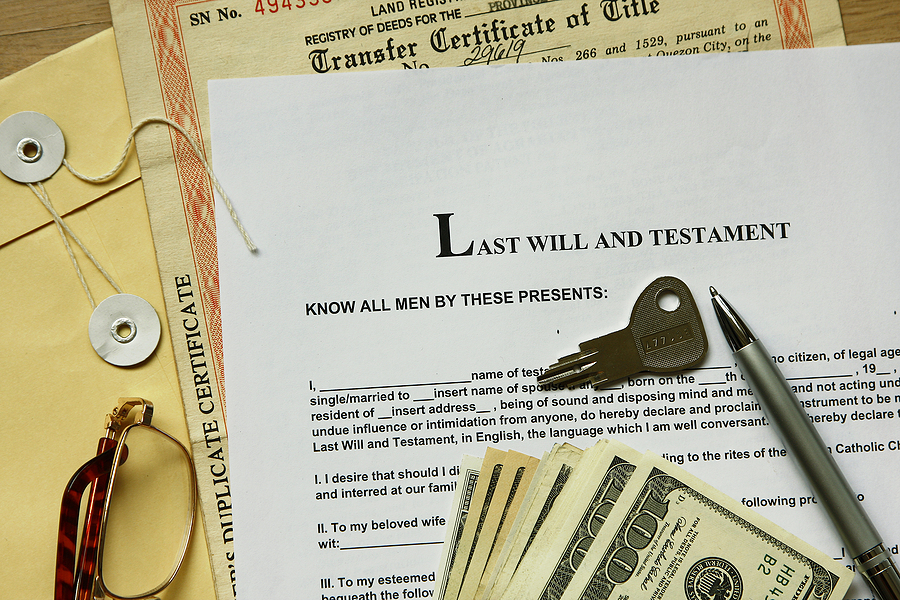

The estate plan is meant to ensure your property is properly distributed and managed in a way that would want it all done. With this plan, you will have spelled out what you would want to happen to your assets and possessions in case you die or in no position to make such decisions. This is where making a Will comes in, a document that spells your wishes regarding the distribution of assets and property. Sometimes it also includes how you want your children or beneficiaries to be taken care of and by whom, which makes filing a probate a lot easier for your loved ones.. Without this, the state or local government will make the decision for you, and it might not be as you would have wished. You, therefore, need to make sure to document your wishes so anyone who will be in charge of executing them will have a point of reference.

3. Set Up Guardianship for Dependents

If you have a minor or someone with special needs that will be under a guardian in case you are not there, it is wise to have that organized as well. If you do not choose one, a judge will do it for you. You are in the best position to make such a decision as you know who will uphold your wishes to the best of your interest.

You need to appoint them ahead of time so they can give their consent. They don’t necessarily have to handle your financial issues. They will be in charge of the minors or the people with special needs until they are in a position to do so. Your attorney will advise you on how to approach issues like a couple you have appointed as co-guardians get a divorce.

4. Use Trusts

Sometimes you have money that you would wish your heirs to get. You should therefore consider having a trust holding your money. You will need to decide what amount to put into the trust, who will get what, and how the distribution process is to be conducted. With a well-structured trust, you can easily ensure that all your wishes are upheld even when you are not there. However, make sure you have legal advice throughout the process.

5. Plan for the Taxes

If your estate is huge enough, it is most probably subject to federal tax. If this is the case, you need to have a plan on how estate taxes will be handled. This is even more important if much of your estate isn’t in cash form. If it means selling a property you may have wanted an heir to have, it’s good to consult a tax professional when making the estate plan so you know what to do about your circumstances. That way, you will have ensured that your taxes (which are due within nine months of your death) are well handled, and your heirs get what you would have wished them to have.

6. Keep Your Beneficiaries Informed

You need to know that if you have accounts named after beneficiaries, they will get the money in there once you are dead even if your estate plan says otherwise. Therefore, you need to make sure that your estate plans align with beneficiary designations in the financial institutions where you have money. It’s also good to have your beneficiaries in the loop to avoid confusion during the distribution.

If you are drafting your estate plan and want to make sure it accomplishes all your goals, the tips in this piece should make sure that happens.

Image Source: BigStockPhoto.com (Licensed)

Related Categories: Legal, Family, Religion