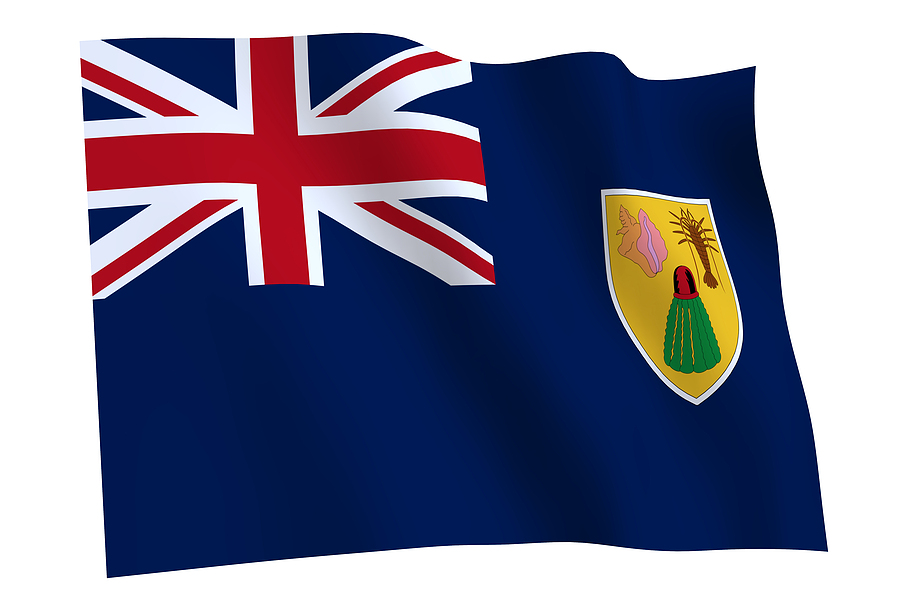

COVID-19’s effects are far reaching and have seriously affected the tourism sector of the Turks and Caicos Islands (TCI). These Islands however, are made up of resilient people, with the nation having quickly recovered from one of the fiercest hurricanes of all times (Irma) in 2017, which was the first Category 5 hurricane to strike the Leeward Islands on record, only to be followed by hurricane Maria two weeks later. The quick recovery led to strong tourist seasons for 2018 and 2019 and it was set to be the same for 2020. That is until COVID-19.

Anthony R. D’Aniello, a senior international attorney and investment banker, is confident that business in TCI will boom again. Not only will TCI’s rebound be due to its people, but the investor laws are friendly and investment opportunities are in abundance.

An Overview

Anthony D’Aniello recalls a day 26 years ago when he was sitting in a downtown Toronto travel agency with the travel agent repeatedly asking him where he wanted to travel. While he responded, “Providenciales, Turks and Caicos” several times, the agent was unfamiliar with the location and didn’t even know where it was.

Today, there is no question as to where the Turks and Caicos Islands are located, with Providenciales winning the world’s best beach according to Trip Advisor. TCI has become a phenomenon. Like any place else, it has had its ups and downs, but its future continues to be as bright as the sun that graces its shores.

In addition, the TCI government has created a highly attractive investment policy in order to facilitate the ease of doing business and create an excellent investment climate. Foreign direct investment is welcome. There are no restrictions or limitations to foreign ownership of land or property and it can be owned either by individual investors or by companies. With no capital gains taxes on land and property, TCI is an interesting investment proposition. TCI is a small developing country with a skilled professional workforce, solid infrastructure, and an open economy for tourism, financial services, light manufacturing, agriculture, technology, mari-culture, and fishing investment opportunities. To make it even more conducive to invest, there are no income, corporate, inheritance, or annual property taxes.

Why is TCI an Ideal Location to Invest?

Turks and Caicos Islands’ well-regulated financial services industry, proximity to major North and Latin American markets, and use of the U.S. dollar make it an ideal place to invest, notes Anthony Robert D’Aniello. TCI is known as a corporate domicile for businesses, trusts, captive insurance, and ship registry. It is also home to reputable, international financial brands offering a full range of financial services. The TCI Financial Services Commission works closely with the UK to ensure that its financial services industry meets the highest international standards. The legal system is common law and appeals can be made to the privy council in the UK.

Tourism

TCI have focused their efforts on developing the high end tourism market with resounding success. Tourism is now the main source of revenue and along with the revitalization of the financial services industry, it has created economic stability and growth in TCI. The major expansion of the Providenciales airport accommodating direct flights from Canada, the USA, Europe and Latin America along with several brand name new hotel and residential property developments in the works will perpetuate this economic growth.

Final Thoughts from Anthony D’Aniello

Access to world-class amenities, idyllic beaches, and captivating natural beauty make TCI the ultimate destination. Whether you are considering TCI for a business investment, a vacation home or a permanent residence, it is available to you. Come be a part of paradise too and capitalize on the many business and investment opportunities.

Anthony Robert D’Aniello is a Senior International Attorney/Investment Banker. He is qualified as an attorney both in Ontario, Canada, the Turks & Caicos Islands and UAE (legal consultant/manager). He has held several executive positions throughout North America, the Caribbean and Middle East dealing with and advising ultra-high net worth clients. Anthony is a trusted advisor to the private offices to members of the Royal Family in Dubai. His practice areas include corporate and commercial law with emphasis on real estate, resort development, infrastructure project, public private partnerships (PPP), finance, trusts and wealth management.

Image Source: BigStock.com (Licensed)

Site Disclaimer

The Content in this post and on this site is for informational and entertainment purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by HII or any third party service provider to buy or sell any securities or other financial instruments.

Nothing in this post or on this site constitutes professional and/or financial advice. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this post or on this site.

You recognize that when making investments, an investor may get back less than the amount invested. Information on past performance, where given, is not necessarily a guide to future performance.

Related Categories: Invest, Money, Reviews