If you’ve ever been involved in a fire, it’s likely that the thought of filing a claim with your insurance company immediately flashed through your mind. However, before doing so, it is important to make sure you have taken all necessary steps to protect yourself and your home.

A fire can happen to anyone. Whether you have smoke alarms and working fire sprinklers in place, or if you’ve been lax in the upkeep of your home, the risk of fire damage is still present. By avoiding these five common mistakes when filing a fire insurance claim, you will be setting yourself up for a successful experience.

1 – Failing to file a claim

This may seem self-explanatory but it is an issue that many homeowners face. It is important to remember that by failing to file a claim with your insurance company, you are not protected in the event of a fire. Most policies will require you to file within a certain time period in order to benefit from the protection of your policy. If you do not file within this time limit, you risk losing out on the opportunity to recover any financial loss.

2 – Not reading the policy

This is also an important mistake that many avoid. Failing to read your policy will result in you not having all the information you need to file a claim. There may be different restrictions on what can be done with the fire damage, or how much deductible is required. For example, ensuring that you are aware of what damages your insurance company will cover is crucial when filing your claim.

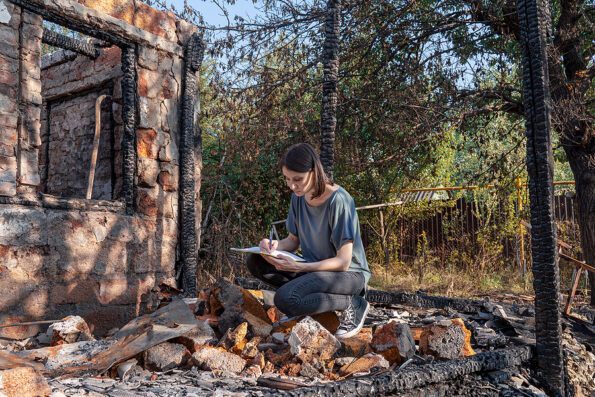

3 – Not taking pictures

In the event of a fire, it can be easy to become overwhelmed and forget to take pictures of the damage. By taking pictures and saving receipts, you are able to provide your insurance company with proper documentation of your loss. Pictures make it easier for the professional from your insurance company to assess what damage has occurred, as well as helping you understand what is covered in your policy.

4 – Not having an inventory list

This is one of the most important components of filing a claim on your home. Without having a detailed inventory list, your insurance company will not be able to assess the cost of the loss. This can cause you to lose out on financial compensation. A home inventory list will give your insurance company detailed information about what exactly has been lost or damaged in your home, as well as how much it is worth.

5 – Failing to have a professional assess the claims

It’s difficult to imagine that you could forget to file your claim with your insurance company, but it’s important to note that this is something that can happen. If you are unable to file a claim, or if you encounter another obstacle during the process, it is advised to contact a professional for assistance. A professional will be able to assess your claim and submit an insurance claim for you.

It is also advisable that you keep your home as free as possible from any vulnerabilities, if you are not able to avoid a fire. A number of home fires have been prevented by homeowners who have taken steps to prevent them. This is why it is so important to take action when a fire strikes. If you are best suited to prevent a house fire, you are also likely to be prepared if you need financial compensation in the event of a fire.

Fire is one of the most common causes of home losses. These five steps will ensure that you can take full advantage of your insurance policy in the event that fire strikes and by following these simple steps, you will be taking the right steps to protect your family and home.

Image Source: BigStockPhoto.com (Licensed)

Related Categories: Money, Reviews