Business owners routinely encounter a unique dilemma, questioning whether or not a family office separate from the business itself, would be beneficial to pursue. Wealth Management through a family office is an important resource many high net worth business owners can benefit from.

The family office is a unique service that is created to provide tailored wealth management solutions (from investments to philanthropy) in an integrated fashion while promoting and preserving the identity and values of the family. All look to the family office to provide professional, private, and conflict-free management of their affairs to increase their chances of sustaining their human and financial capital for the long term. Family offices provide the all-important services that build and preserve family wealth, supporting the financial, legal, and administrative needs of a specific family group. Many family-run businesses opt for such an arrangement because it creates advantages.

Anthony Robert D’Aniello, an experienced legal consultant and wealth manager, has garnered an impeccable reputation through his efforts as an international tax and estate planning attorney, and investment banker that has spent the last 27 years dealing and assisting the ultra-wealthy of the world. Anthony shares vital information relating to family offices.

Types and Components

Broadly speaking, there are three varying types of family offices according to Anthony Robert D’Aniello : a Single Family Office (SFO) is the first option, established for one individual family; a Multi-Family Office (MFO) serves the needs of multiple families, offering a single point of contract for planning and implementation, as well as a method of sharing family office functions; and the final alternative is a Commercial Family Office (CFO).

After selecting the type of family office that suits your business to the utmost, you must familiarize yourself with the various components that are incorporated. A family office is expected to oversee tax advice and planning, estate strategizing, offshore services, financial services, individual insurance, banking, accounting services, and legal services.

Each family office provides services that are reflective of the goals and priorities of the family. Some offices focus heavily on the investment process and rely on the expertise of a chief investment officer and investment staff to oversee the deployment of the family’s financial assets; others focus on recordkeeping, reporting, and compliance and outsource the investment process. The make or buy decision – whether to provide services internally, with the assistance of external advisors or to outsource completely – is one that every office considers in an effort to provide the best possible service for a fair price.

Primary Responsibilities

Anthony Robert D’Aniello states that a family office is tasked with a particular set of responsibilities: advising for the family’s best interests; ensuring a personalized focus, along with control over family finances and legal matters; providing a formal communication process; offering customized services; delivering cost control and economies of scale; assuring new opportunities for each generation; introducing complete privacy and confidentiality; and bolstering a family’s mission and legacy.

Also, a family office has to address the needs of multiple family entities, including patriarch financials, spouse financials, inherited trusts, equity partners, non-business investors, business investors, charities, and auditing. Every family office is as unique as the family it serves reiterates Anthony D’Aniello.

Recommended, Prosperous Areas

Certain areas of a business are ideal for a separate family office, Anthony Robert D’Aniello notes. Firstly, it can act as a superb advocate for the family by putting their needs first, educating and mentoring the younger generations, developing governance structures, and promoting non-financial family ambitions.

Larger families can preserve continuity through a secondary office, making it simpler to determine group decisions when the family expands its branches and avoiding any potential disputes.

For families who prioritize philanthropic commitments, a separate office will clarify their values and vision, evaluate fitting targets and involve younger family members in the process.

Family education is highlighted, as a separate office finalizes values and mission statements, supplies a forum for discussing issues unrelated to the family business, installs family education programs, and develops a multi-generational blueprint.

Investment advisory is solidified, with trading, tracking, consistent monitoring, manager reviews and appointing, alternative investment opportunities, strategies, and asset location all taken care of adequately.

Finally, estate planning is strengthened via diversification and the monetizing of concentrated holdings, limiting the risk and dependency on the business. In addition, the transferring of wealth to future generations is secured.

Final Thoughts from Anthony Robert D’Aniello

A family’s cycle of continued wealth creation and preservation is impressively boosted by a separate and independent family office, Anthony Robert D’Aniello concludes. Family objectives and priorities are confirmed, assets are guided astutely, dynamics and governance are simplified, financial plans are documented in extensive detail, family education programs are integrated, superior communication is evident, and the family’s vision is reaffirmed and brought forward for the future generations.

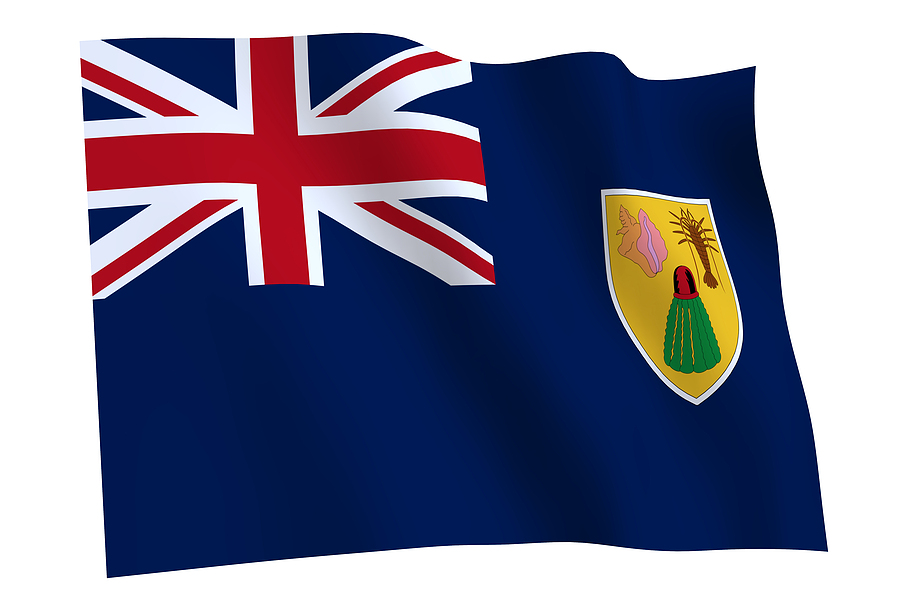

Anthony Robert D’Aniello is a Senior International Attorney/Investment Banker. He is qualified as an attorney both in Ontario, Canada, the Turks & Caicos Islands and UAE (legal consultant/manager). He has held several international positions throughout North America, the Caribbean and Middle East dealing with and advising ultra-high net worth clients. His practice areas include corporate and commercial law with emphasis on real estate, resort development, infrastructure project, public private partnerships (PPP), finance, trusts and wealth management.

Site Disclaimer

The Content in this post and on this site is for informational and entertainment purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by HII or any third party service provider to buy or sell any securities or other financial instruments.

Nothing in this post or on this site constitutes professional and/or financial advice. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this post or on this site.

You recognize that when making investments, an investor may get back less than the amount invested. Information on past performance, where given, is not necessarily a guide to future performance.

Related Categories: Money, Reviews