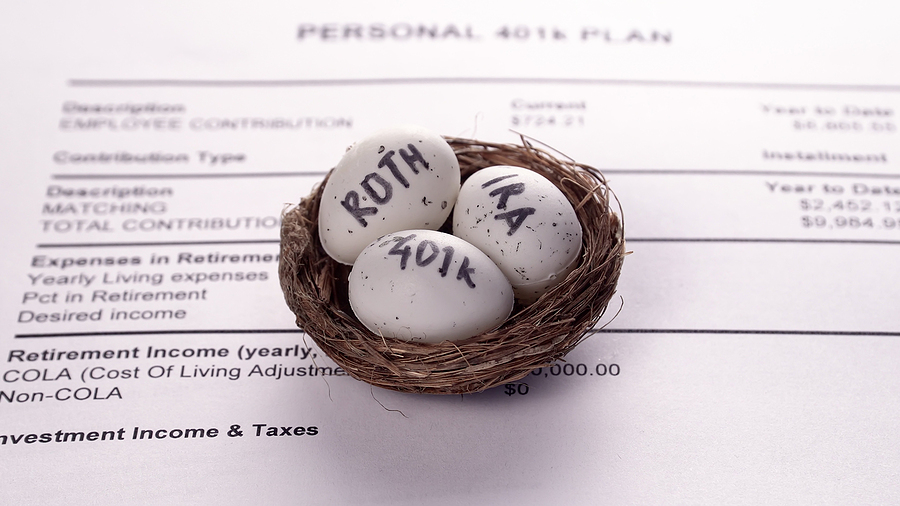

Many workers are responsible for their savings and funds when they retire today. While these financial instruments are not usually required to be taught in high schools and colleges, it’s essential to research them when you start working.

The earlier you save, the better the results will be for Roth IRAs 403(b)s and traditional ones like 401(k) plans. A comfortable retirement with enough funds to save for medical expenses and a retirement home should be your priority regardless of the size of your paycheck or your current career.

How to Be Successful in your IRA Account?

- Start While You’re Young

The best day to save is today and even if this is only a bit of your income. You can check other products in the market where you can put your money like gold and read about companies and comparisons to understand diversification. It’s best to put your money in stocks, bonds, and mutual funds, but you should also consider precious metals while you’re young.

Know that you can take advantage of the snowball effect that can be advantageous when you’re starting early in life, especially if everything is tax-free or tax-deferred. The returns can be reinvested, and they can generate returns, and this cycle continues until you have a compounded interest. You can get more significant balances before you know it.

In the past, you may be discouraged with the amount that you’re contributing, especially if it’s not the maximum. Now is a great time to invest in whatever you can. Smaller contributions can help your nest egg expand if you give it more time.

- Contribute Whenever You Can

It’s best to make contributions whenever you have the time, and you don’t have to wait for taxes. People who usually file for taxes on April 15 of the following year are also making their contributions simultaneously. However, the problem with waiting is that you’re not letting the money grow in 15 months. You may be risking missing the higher points of the market in a given year.

Contributions at the start of the fiscal or tax year will allow everything to compound, especially if this will be for an extended period of time. Monthly contributions will be easier on your budget, and you can take advantage of the market growth whenever you can. Learn more about a fiscal year on this page here.

If you have plenty of stocks in your individual retirement account, the good news is that you’ll have equal contributions through the entire fiscal year. This is a strategy used by many people that is called dollar-cost averaging. You’re taking out the guesswork away from the market timing, and you can become more disciplined to save for your retirement.

- Have a Look at your Whole Portfolio

The IRA may be a part of the funds that you’re setting up for the future. Most of the money may still be located in taxable and regular accounts. The financial advisors today recommend that you distribute your investments on various accounts and look at how they can be taxed.

What this means is that the bonds with dividends may be taxed and considered as ordinary income. They are best bought for self-directed retirement accounts to postpone the tax bills. The generated capital gains of the stocks are taxed at a lower rate, so they are better utilized in a taxable account.

However, in practice, things may differ a bit. For example, mutual funds that are actively managed can create many taxable capital gains, and they can do better in an IRA account. If you have index funds that are passively managed, they are more likely to produce capital gains distributions, which can be fine in taxable accounts.

For some people, the bulk of their retirement savings are often sponsored by their employers, such as in the case of a 401(k). This can already be invested conservatively, and you can use the IRA to diversify and become more adventurous. You can diversify through precious metals, emerging foreign markets, specialized funds, real estate, and small-cap stocks. You can know more about small-cap stocks here: https://www.fool.com/investing/how-to-invest/stocks/what-is-market-cap/.

- Invest in Individual Stocks

One of the most common products in an IRA account is mutual funds. They are easily offered, and they provide diversification. They usually do better on average through tracking specific benchmarks.

Generally, these individual stocks will give you an overall lower management fee, better control, and more tax efficiency. However, there may be a way to get higher returns if you have the time to pick the individual stocks yourself. You can spend time being an expert, and these specific picks can yield a high return for you in the long run.

- Roth IRA Should Be Considered

Taxpayers often consider converting their traditional IRA from another company into a ROTH IRA. The ROTH will make more sense, mainly if you belong in a higher income tax bracket when you retire. You don’t have any limits on the money to convert from your traditional individual retirement account to your ROTH IRA. Income eligibility is not present either.

Usually, this conversion is favorable for people who make too much money. They are often the ones who want to contribute to their ROTH by rolling over some of the funds from their traditional IRA. It’s worth noting that there’s still income tax on the funds in the year you’ve converted them into ROTH, so you should look at the numbers first before making decisions.

Image Source: BigStockPhoto.com (Licensed)

Site Disclaimer

The Content in this post and on this site is for informational and entertainment purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by HII or any third party service provider to buy or sell any securities or other financial instruments.

Nothing in this post or on this site constitutes professional and/or financial advice. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this post or on this site.

You recognize that when making investments, an investor may get back less than the amount invested. Information on past performance, where given, is not necessarily a guide to future performance.

Related Categories: Invest, Money, Reviews