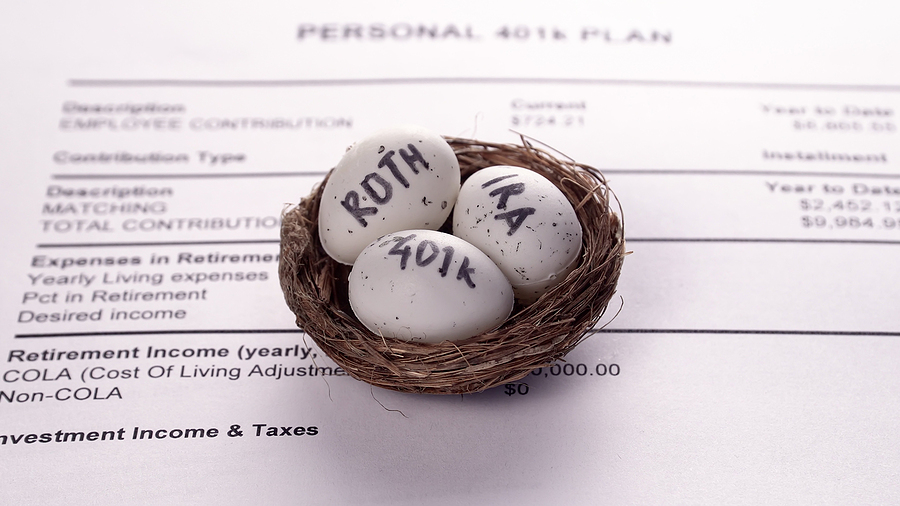

When you think about retirement you may start to take in that your career is coming to an official end. It’s a milestone that a lot of people hope to reach, but that milestone can come with a sense of worry, but why? Owners of an IRA (or Individual Retirement Account) or a 401(k) understand that feeling. As an owner of either one of these, you may often find yourself worrying about inflation. There may be cases where economic inflation could have some sort of effects on any of your assets. Which leads to people looking for a better, more long-term choice to invest in. That’s exactly where precious metals can come into play, they offer that long-term investment that you’ve been hoping to find. Being time-tested, precious metals have been proven to be both a reliable and solid investment to make. Even in times of economic uncertainty, the values and prices of precious metals will continue to climb.

Precious metals have been a huge part of the world for centuries, so they have always been known as a safe asset to invest in. Your retirement portfolio plays a key role when looking to execute your retirement plan. By including some precious metal investments, you may be able to eliminate some of that worry. Plus, it’s always a plus when you can keep your portfolio as diversified as possible.

Now, people are starting to invest in gold backed IRA and for a good cause too. With a gold IRA, you’ll be able to open an account capable of doing multiple things (rollovers, transfers, contributions, etc.). A gold IRA is something that everyone is taking interest in, but they also have questions of their own.

So Why Should You Invest In Any Gold IRA?

There are many things that you could expect to come out of officially retiring, and it could be anything really. Leading up to that point you may start to put together different strategies. A few ways for you to impact that way you retirement will turn out. This isn’t something that isn’t common, it’s something that a lot of people try to do. With there being a number of strategies to go with you mainly wonder what’s the best way to improve. Because you want to be able to keep your future intact without hurting yourself now. Not a lot of people know about the potential weaknesses that come along with investing in 401(ks) or basic IRAs. For the most part, you could use a gold backed IRA as the perfect tool that’ll help keep matter diversified. Even if a case of inflation strikes that economy, gold (along with other precious metals) will keep its value. In fact, there is a chance that their values could increase, that’s why this kind of investment is considered one of the smartest you could go with.

Gold through the years has been in high demand considering it’s a huge part of many global industries (mainly jewelry stores). It’s like a tool to help you change your future in terms of retirement. With gold continuing to be around for as long as it has been, you can expect it’s value to continue to climb in the years to come. You can also buy ArcheAge Unchained gold.

Matters That Have To Be Understood

Knowing all of this is great, but there is still a lot that you have to understand before you jump into gold investing. Just like a lot of things in the world, the IRS has regulations that have to be followed, even with precious metal IRAs. Which means there is stuff you can’t do and there is stuff that you will be able to do. The first thing you want to know is the types of precious metals that can be included besides gold (platinum, palladium, and silver). Along with that, your metals have to be held by a IRS approved custodian. You won’t be able to keep these things on your own terms, but it’s up until you reach the proper age of retirement.

There is a lot to take in, and it helps you understand that things can be much deeper in the retirement world than you are lead to believe. If you can build the perfect portfolio, then you’ll be looking at a nice future in the retired life.

Image Source: BigStock.com (licensed)

Site Disclaimer

The Content in this post and on this site is for informational and entertainment purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by HII or any third party service provider to buy or sell any securities or other financial instruments.

Nothing in this post or on this site constitutes professional and/or financial advice. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this post or on this site.

You recognize that when making investments, an investor may get back less than the amount invested. Information on past performance, where given, is not necessarily a guide to future performance.

Related Categories: Money, Reviews