Have you thought about your future and retirement?

Choosing a retirement plan consultant can be a big step in preparing for your future. These experts help you make smart decisions about saving for retirement. They look at different retirement plans and find the best one for you.

The next sections will guide you on what these consultants do and how to choose the right one for you.

What Retirement Plan Consultants Do

Retirement plan consultants make sure you have enough money when you retire. They offer a range of services aimed at helping clients achieve their retirement goals. These services may include:

Plan Design

Retirement plan consultants work with you to create a custom retirement plan. They look at different options and pick the one that fits your goals and finances. This means they help you choose how much to save and where to invest your money for the best outcome.

Investment Advice

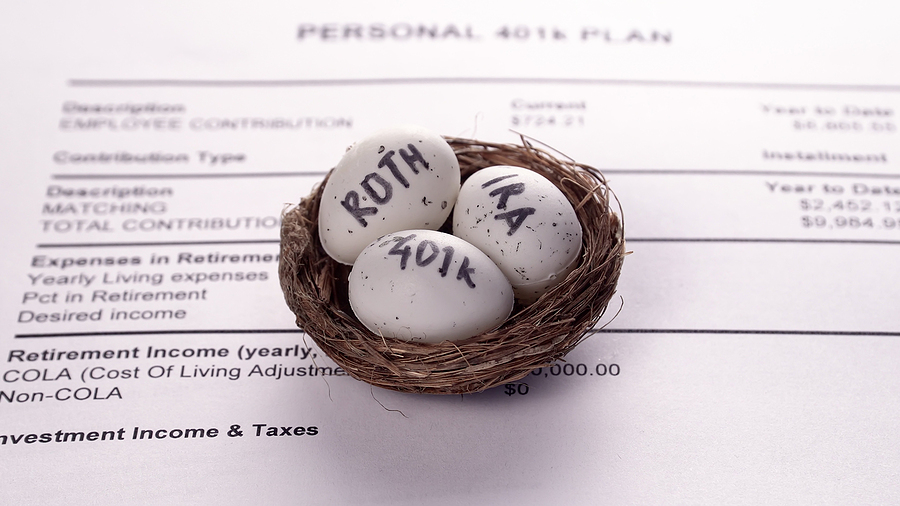

Retirement plan consultants offer key advice on investing. This includes the introduction to 401k plans, a popular choice for many. They guide you in selecting the right investments within your 401k that match your retirement goals and risk tolerance, ensuring your money grows over time.

Compliance and Regulation

Retirement plan consultants make sure your plan follows the law. They keep up with rules and help you avoid fines. You can trust them to handle the complicated legal part, so you can focus on saving for your retirement.

Employee Education

Retirement plan consultants also teach your workers about their benefits. They explain how to save for retirement, choose investments, and understand their plan. This helps everyone feel more confident about their future and encourages them to save more.

Plan Monitoring and Adjustment

Retirement plan consultants regularly check your plan’s performance. If goals aren’t being met, they adjust strategies to keep on track. This means they might change investments or savings amounts to make sure you can retire as planned.

Choosing the Right Consultant

Selecting the right retirement plan consultant is crucial for achieving your retirement objectives. Here are some factors to consider when making your decision:

Experience and Expertise

The best consultant has lots of experience and knows about retirement plans. They should understand different retirement needs and how to meet them. This ensures they can give you advice that really works for you.

Credentials and Certifications

When choosing a consultant, check their credentials. Look for certifications like CFP or CPA, which show they’re qualified. These mean the consultant has the training and knowledge needed to help you plan for retirement. Pick someone with the right credentials to ensure you’re getting expert advice.

Client References

Ask for client references to see how satisfied others were with the consultant. This will give you a clear idea of their success in helping people plan for retirement. Happy clients mean the consultant delivers good advice and cares about client satisfaction.

Fee Structure

Understand the fee structure before hiring a consultant. Some charge a flat fee, others a percentage of your assets. Choose what works for your budget. Clear fees mean no surprises. It’s crucial for a good partnership.

Find the Right Retirement Plan Consultant

Finding a good retirement plan consultant can make saving for later life easier. They help pick the best ways to save and grow your money, so you can enjoy your future without worry.

Choose someone who listens and knows about different retirement plans. The right consultant will be a big help in getting ready for a happy retirement.

Please take a look at our blog for more educational articles.

Image Source: BigStockPhoto.com (Licensed)

Related Categories: Money, Invest, Reviews